In this blog, we focus on the key components of a full-stack application and discuss strategies and tools for implementing effective monitoring and logging in Azure.

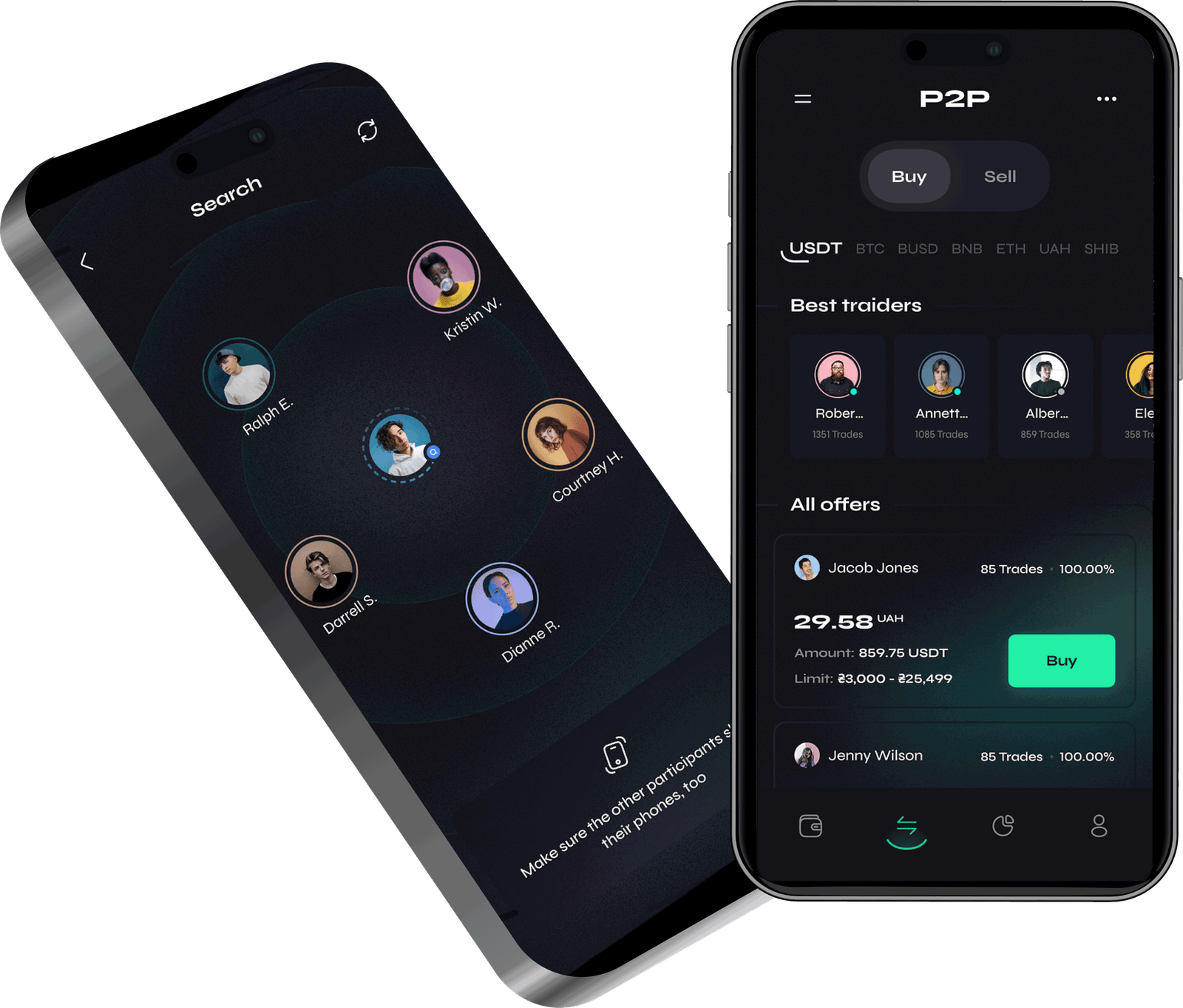

Home » P2P App Developement

Minimizes costs by cutting out intermediaries, offering borrowers lower interest rates, and providing lenders with higher returns.

Streamlines the lending process, speeding up loan approval, reducing manual tasks, and ensuring a smooth and efficient experience for both borrowers and lenders.

Provides customized solutions, allowing borrowers to choose loan terms that suit their needs and enabling lenders to pick borrowers according to their risk preferences, offering a flexible lending ecosystem.

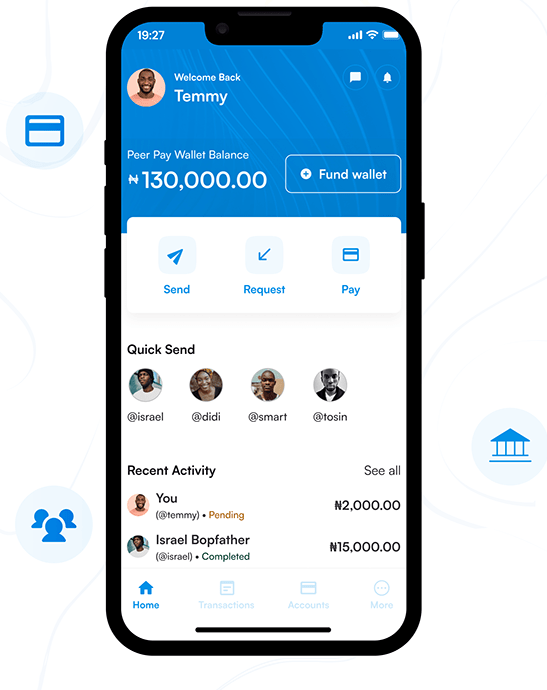

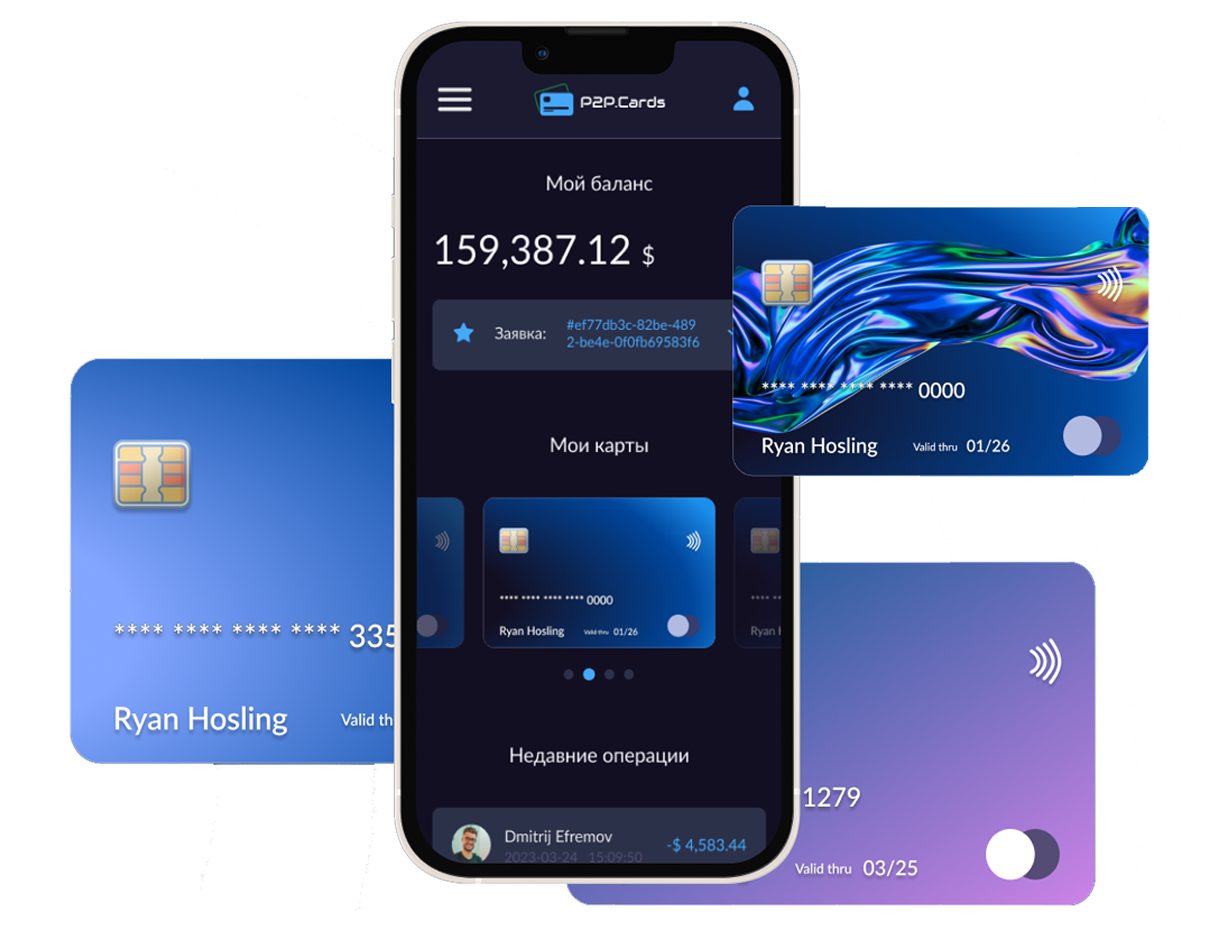

Offers transparency by providing borrowers and lenders with real-time access to loan details, interest rates, and repayment schedules.

Investors in P2P lending enjoy a diverse range of investment options, spreading risk and potentially earning higher returns than traditional investment avenues."

P2P lending platforms provide borrowers with quick access to funds, often within days, making it an ideal choice for those in need of rapid financial assistance.

Minimizes costs by cutting out intermediaries, offering borrowers lower interest rates, and providing lenders with higher returns.

Streamlines the lending process, speeding up loan approval, reducing manual tasks, and ensuring a smooth and efficient experience for both borrowers and lenders.

Provides customized solutions, allowing borrowers to choose loan terms that suit their needs and enabling lenders to pick borrowers according to their risk preferences, offering a flexible lending ecosystem.

Offers transparency by providing borrowers and lenders with real-time access to loan details, interest rates, and repayment schedules.

Investors in P2P lending enjoy a diverse range of investment options, spreading risk and potentially earning higher returns than traditional investment avenues."

P2P lending platforms provide borrowers with quick access to funds, often within days, making it an ideal choice for those in need of rapid financial assistance.

Choose our all-inclusive, P2P lending software development services. We serve a wide range of industries, ensuring that our lending solutions are customised to meet your unique requirements.

Choose our all-inclusive, P2P lending software development services. We serve a wide range of industries, ensuring that our lending solutions are customised to meet your unique requirements.

From ideation to successful deployment, we guide your P2P lending project through every stage

We kickstart your P2P lending project by rigorously validating the concept, ensuring its viability and potential.

We proceed to the development phase, constructing a robust P2P lending platform by using the latest technologies.

Our team conducts an extensive market analysis, gaining insights into the competitive landscape and identifying opportunities.

Your platform undergoes rigorous testing, ensuring utmost reliability, security, and peak performance.

We craft interactive dashboards that optimize user engagement and user-friendliness, a pivotal stage in our approach.

Throughout the process, we maintain meticulous project documentation, delineating goals, requirements, and specifications.

Before diving into development, we create wireframes to visualize the app's layout and user interface, guaranteeing an exceptional user experience.

We guide you through a seamless deployment process, setting the stage for the triumphant launch of your P2P lending venture.

We provide you with expert guidance from start to finish. From code review to market analysis, we offer a range of consulting services under one roof to ensure that your P2P lending project is built on a solid foundation.

Get comprehensive support from code review to market analysis. Establish a robust foundation for your P2P lending software development project with our expert guidance.

Efficiently publish loan applications and set payback periods.

Enable borrowers to view and pay pending loan amounts online.

Provide users with tools to calculate total interest and EMIs.

Establish trust with a system for rating borrowers and lenders.

Gain valuable insights from user behavior data and real-time analytics.

Help borrowers easily track their EMIs for loan repayment.

Simplify identity verification and manage KYC details.

Enhance security through blockchain technology.

Enable auto-renewal for smoother loan repayment.

Explore our portfolio for success stories. Here, we spotlight case studies reflecting technology's impact, empowering businesses and individuals to achieve success.

Explore More >>

GovWins is an all-inclusive software solution that simplifies government contract complexities. It offers an easy-to-use platform that guides businesses through the contracting…

Loan Cirrus is your modern financial companion, reimagining the loan experience for you. It is your go-to destination for tailored loan solutions that align with your goals and dreams…

Optrax is a mobile application that tracks employee activity based on their location. It allows employees and site managers to create and log in to accounts…

The project centres around an innovative mobile networking application known as “Ask Around” that seamlessly connects users with local service providers and sellers….

The Odenza Web Application is designed to simplify vacation offers and enhance guest management. With three distinct user roles – Odenza Admin, Master Admin…

In this blog, we focus on the key components of a full-stack application and discuss strategies and tools for implementing effective monitoring and logging in Azure.

Azure Cosmos DB is an excellent choice for creating responsive, globally distributed applications, including e-commerce platforms, IoT solutions, gaming systems, and real-time analytics.

In our guide, we dive into the importance of securing APIs and introduce you to OAuth2.0, a powerful protocol designed to defend your API endpoints. Our mission? To equip you with the information and tools needed to assemble a rock-robust API with Node.js and OAuth2.0.

Schedule a Customized Consultation. Shape Your Azure Roadmap with Expert Guidance and Strategies Tailored to Your Business Needs.

.

55 Village Center Place, Suite 307 Bldg 4287,

Mississauga ON L4Z 1V9, Canada

.

Founder and CEO

Chief Sales Officer