Rewards

.

CANADA

55 Village Center Place, Suite 307 Bldg 4287,

Mississauga ON L4Z 1V9, Canada

Certified Members:

.

Home » Dynamics 365 Finance Implementation Guide: Timeline & Budget for Banking Institutions

Banks are under constant pressure to manage their finances properly while following strict rules. Traditional financial systems can’t fulfil these demands which leads to many mistakes and slow processes. This is where Microsoft Dynamics 365 Finance helps. It offers a modern system that makes budget planning easier, improves how costs are tracked, and helps banks follow industry regulations.

This is a cloud-based system used by many financial institutions in order to manage their finances, being part of Microsoft Dynamics 365 Finance and Operations modules (also called D365 F&O modules). It automates financial tasks, tracks spending, and provides real-time reports, which is useful for banks dealing with large amounts of financial data.

With features like an allocated spending plan Excel and a budget scenarios worksheet, banks can easily plan their budgets, explore various spending options, and keep track of their expenses. Making it easier for banks to manage their financial plans.

Each bank is different, so does their financial systems are. Dynamics 365 Finance allows banks to customize their processes and reports. It also works smoothly with other Microsoft tools to easily manage everything in a unified place.

For example, when a bank is creating a budget planning report, Dynamics 365 Finance allows financial managers to:

This step-by-step process helps banks stay on top of their finances while meeting banking compliance standards.

Dynamics 365 Finance in a bank is not something that can be implemented overnight. It requires a definite plan to ensure everything works smoothly. Whether you are switching from your existing system or starting new, having a clear Dynamics 365 Finance implementation timeline for banking helps you to avoid confusion and possible delays.

Below we are going to discuss the key steps involved, from the first plan to the final launch. Each stage is significant and helps the bank get the best out of Dynamics 365 Finance and Operations modules.

The first step in the Dynamics 365 Finance project timeline for banking sector is planning. This means understanding what the bank needs and how D365 Finance and Operations modules can help. During this stage, banks work with their teams to:

1. Define Goals: What problems will Dynamics 365 Finance solve? For example, is the goal to improve budget planning or follow strict banking compliance rules?

2. Outline the Budget: Create a detailed cost estimation for Dynamics 365 Finance implementation in banks. This ensures the bank knows how much to spend and where.

3. Set a Timeline: Decide how long the process will take. Most banks take 6 to 12 months to fully set up Dynamics 365 Finance.

At this stage, banks also gather all financial data, such as past spending records and allocated spending plans in Excel, to prepare for the transition.

Once you are ready with your plan, set up Dynamics 365 Finance to match the bank’s needs and requirements, which focuses on customizing the system. Each bank is different, so the system should be adjusted to handle specific tasks like budget scenarios and financial reports.

During this stage, experts work with bank staff to:

This phase also includes testing small parts of the system to find and fix any problems before moving forward.

One of the most time-consuming but significant steps is migrating financial data from existing old systems into Dynamics 365 Finance. Ensuring no important information is lost during the switch.

At this stage, banks:

1. Transfer Data: Move all financial records, including budget plans, spending reports, and budgeting scenarios.

2. Test the System: Run tests to check if everything works correctly. This includes making sure Microsoft Dynamics 365 Finance and Operations modules can process real financial data.

3. Fix Issues: If problems arise, they are solved before the system goes live.

Banks also prepare for real-world situations by testing how the system handles different budget scenarios. This helps avoid mistakes once the system is fully operational.

A new system is only helpful if the user knows how to use it. That’s why training is a key part of the Dynamics 365 Finance implementation roadmap for financial institutions.

During this phase, staff are trained to:

Training sessions may last a few weeks, depending on the size of the bank. Ongoing support is also provided to help employees adjust to the new system.

After several months of preparation, it’s time to officially launch D365 Finance. At this point, the system is fully active, and all financial operations are managed through it.

Banks continue to monitor the system to ensure smooth operations. Regular checks help keep everything running well and ensure the system stays updated with the latest features.

A well-planned Dynamics 365 Finance implementation timeline for the banking helps avoid delays and confusion. It also ensures the bank meets important legal requirements while improving daily financial work.

Next, we will explore budget planning for Dynamics 365 Finance in banking institutions, sharing tips to manage costs and keep financial operations running smoothly.

Get free Consultation and let us know your project idea to turn into an amazing digital product.

In order to implement Dynamics 365 Finance involves different types of cost. These depend on various scenarios like what the size of the bank is, are there any features needed, and how long the project takes. Here are the main expenses banks should expect:

Start by creating a cost estimation for Dynamics 365 Finance implementation in banks. This gives companies a clear picture of how much the entire project will cost to avoid overspending.

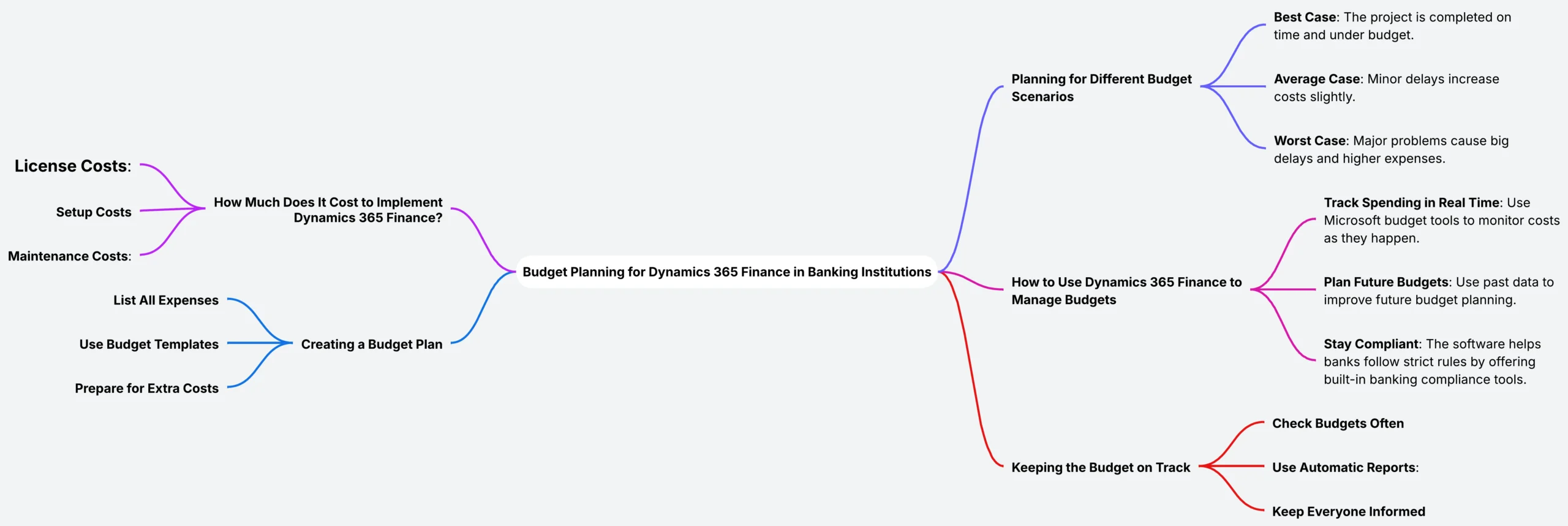

A good budget plan helps banks manage their spending and avoid surprises. Many banks use an allocated spending plan Excel sheet to track costs. Here’s a simple way to create a budget:

1. List All Expenses: Write down every possible cost—software, consulting services, staff training, and future maintenance.

2. Use Budget Templates: Ensure use of Microsoft 365 budget templates to organize and monitor expenses. These templates are helpful to track what has been spent and what is left.

3. Prepare for Extra Costs: We all know that unexpected issues can arise anytime, so it’s better to set aside an extra budget to cover them.

By following these steps, banks can manage their finances effectively during the Dynamics 365 Finance implementation.

In the banking sector financial situations are not the same all the time. That’s why it’s significant to prepare for different outcomes. With D365 Finance, banks can manage budget scenarios worksheets to plan as per different situations.

For example, a bank might want to plan for:

These budgeting scenarios allow banks to stay ready for anything and adjust their spending when needed.

Once the system is completely set up, Dynamics 365 Finance helps banks to manage their budgets. It allows banks to:

With these features, banks can track both current and future spending with ease.

To control costs, banks should review their budget plan regularly during the project. Here are some simple ways to do that:

If banks don’t plan their Dynamics 365 Finance implementation budget carefully, costs can quickly get out of hand. With a clear budget plan, they can manage their money better and keep the project on track.

Compliance in the banking world is no joke. One wrong move can create serious trouble. Dynamics 365 Finance makes this work easier.

Let’s just imagine a world where all your financial reports are error free, audits are smooth, and you don’t lose a wink of sleep worrying about changing banking laws. Sounds like a dream, right? But it’s a reality with Dynamics 365 Finance—if you know how to use it right.

So, how does Dynamics 365 Finance make this easier? Let’s break down its superpowers:

Imagine having real-time, accurate financial reports generated with zero human errors. With budget scenarios worksheets in Dynamics 365, you can track every financial detail and automatically produce reports that meet legal standards.

Every action in Dynamics 365 Finance leaves a digital footprint. Who changed what? When? Why? It’s all there. If regulators come knocking, you’re ready to show them everything—no missing pieces.

Not everyone needs to see everything. With D365 F&O modules, you control who accesses financial data, ensuring only the right people see the most sensitive information.

Having the right tech is step one—but it won’t work without a smart plan. Here’s how to set up a compliance strategy that works:

List every regulation your bank needs to comply with—from data protection laws to financial reporting standards.

Use Microsoft budget templates and allocated spending plans in Excel to align financial processes with regulatory demands.

Set up automated alerts for risky activities. If something looks off, you’ll know before it becomes a big problem.

Regulations change. So should your system. Regularly update your budget planning process and workflows to stay ahead.

Share your project idea with us. Together, we’ll transform your vision into an exceptional digital product!

With this you are clearly aware that managing finances in a bank is definitely not a joke. You have to deal with complex regulations, tight budgets, and the constant need to improve operations. That’s where Dynamics 365 Finance comes in. It is an ultimate solution that helps banks simplify their financial tasks to make better decisions; by carefully planning the implementation timeline and setting a realistic budget, banks can keep everything on track. Moreover, with flexible Dynamics 365 Finance and Operations modules, they can adapt the system to meet specific needs—whether it’s managing daily transactions or handling detailed reports.

Efficiency is the real win here as with Dynamics 365 Finance, banks reduce manual work and speed up their operational processes.

So,are ready to take the next step? Now’s the right time to make it happen. With the right plan and strategy, Dynamics 365 Finance can transform your financial operations.

Curious about why businesses are choosing Dynamics 365 Finance and Operations? Check out this guide to find out more.

Key features include financial reporting, budgeting, accounts payable and receivable, asset management, and expense management.

The implementation timeline can vary, but it generally takes between 6 to 12 months, depending on the complexity and size of the institution.

The main phases include planning, analysis, design, development, testing, deployment, and post-implementation support.

Costs can be widely based on factors such as the size of the institution, customization needs, and the number of users.

Common challenges include data migration, user training, system integration, and change management.

To ensure a successful thorough planning, stakeholder engagement, effective project management, and comprehensive training.

Microsoft and its partners offer various support options, including technical support, training, and consulting services.

It provides tools and features to help institutions comply with financial regulations and reporting requirements.

Financial consolidation features allow for combining financial data from multiple entities into a single set of financial statements.

Integration options include APIs, data connectors, and third-party integration tools.

Accounts payable and receivable features include invoice processing, payment management, and aging reports.

Key considerations include setting budget parameters, defining budget cycles, and using historical data for accurate forecasting.

Reports show that up to 30% of cloud spending goes to waste because of unused resources, over-provisioning, and poor planning. For businesses heavily relying on Azure, finding ways to cut costs without sacrificing performance.

Banks are constantly searching for ways to serve their customers in better ways. Microsoft Copilot is a tool to help finance industries to achieve that. This advanced AI assistant, built into Microsoft 365 apps, is changing how banks manage tasks, handle data, and interact with their precious customers. But before that let’s understand what exactly is Microsoft Copilot, and why it is so important for banking?

Agentic AI is an advanced technology that can do tasks on its own, make decisions, and solve problems. Unlike basic AI, which only follows instructions, Agentic AI can figure things out, adjust when needed, and handle tricky jobs. Microsoft AI Agent is leading the way helping businesses work faster and more efficiently.

Schedule a Customized Consultation. Shape Your Azure Roadmap with Expert Guidance and Strategies Tailored to Your Business Needs.

.

55 Village Center Place, Suite 307 Bldg 4287,

Mississauga ON L4Z 1V9, Canada

.

Founder and CEO

Chief Sales Officer

🎉 Thank you for your feedback! We appreciate it. 🙌